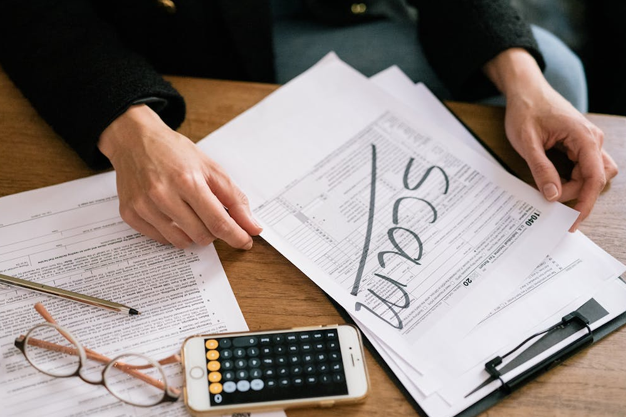

In this modern age, we have witnessed a significant shift towards the adoption of digital technology, with many aspects of our lives becoming increasingly interconnected and accessible through online platforms. As technology advances, online banking has also become a popular way to manage finances, making banking more convenient than ever before. However, with the rise in online banking comes an increase in online bank frauds. Cybercriminals are continually seeking new ways to steal personal and financial information. To safeguard your online bank account, you need to be vigilant and take proactive measures to prevent online bank fraud. Here are five basic steps to follow to avoid online bank frauds:

- Use Two-Factor Authentication:

Two-Factor Authentication is a security feature that provides an extra layer of protection to your online banking account. It involves using two methods to verify your identity when logging in. The first method usually involves entering a username and password, while the second method requires a unique code sent to your mobile phone or email. By using Two-Factor Authentication, you ensure that no one can access your bank account without your permission.

- Keep Login Credentials Secure:

Your login credentials are your first line of defense against online bank fraud. Make sure you choose a strong password that is difficult to guess and change it regularly. Avoid using the same password across multiple accounts, and never share your password with anyone, even your family members.

- Ignore Phishing Emails, Calls & Messages:

Phishing emails, calls, and messages are the most common way cybercriminals try to obtain personal and financial information. They often mimic legitimate messages from banks, credit card companies, or other financial institutions, asking you to provide sensitive information such as your bank account number, PIN, or social security number. Always verify the sender’s identity and avoid clicking on links or downloading attachments from unknown sources.

- Monitor Bank Transactions Regularly:

One of the easiest ways to detect online bank fraud is to monitor your bank transactions regularly. Check your bank statements frequently and report any suspicious activity to your bank immediately. You can also set up alerts for every transaction made on your account to keep track of all transactions in real-time.

- Use Secured Internet / Don’t Do Transactions on Public WIFI:

When it comes to online banking, it’s crucial to use a secure internet connection. Avoid using public Wi-Fi networks when doing online banking, as they are more susceptible to hackers and cybercriminals. Instead, use a secure and trusted internet connection, preferably with a private network. The possibilities that the internet is opening up can always be twisted and used to execute fraud. Keep in mind that cybercriminals are always looking for new ways to obtain personal and financial information, so stay vigilant and take proactive measures to safeguard your online bank account. By doing so, you can enjoy the convenience of online banking with peace of mind. Keeping yourself updated about such banking tips and more financial information is very crucial today. Smart Money provides you with well-curated financial money management training programs as well as personal